Manufacturers, material processors, and other production-oriented organizations in the U.S. all have been singing the same song during these economically lean times: Do more with less. Pushing back or avoiding spending on major capital equipment became a cost-containment strategy that shoved capital equipment suppliers, industrial machine builders, and automation and control suppliers into a deep slump that predated the recession and only got worse as the U.S. economy slowed to a crawl. In addition, with capacity utilization hovering around 74-75%, the chances border from slim to none that any new or significant plant capacity will be added in the U.S. for some time to come.

ARC Advisory Group (www.arcweb.com) director of research Larry O'Brien confirms this: "There continues to be little incentive for adding capacity in the foreseeable future. In the U.S., there's actually some disincentive as producers of all kinds work to drive down capital spending. Doing more with less continues, and ARC is forecasting only moderate potential for growth."

The effects of these market influences continue to be deeply felt by control and automation technology suppliers who saw their markets evaporate along with demand for new capital equipment. There was still plenty of pain being felt this past year. In the first and second quarters of 2003 for example, U.S. tool demand figures, released in November 2003 from AMTDA, The American Machine Tool Distributors' Assn. (www. amtd.org), and AMT, the Assn. for Manufacturing Technology (www.mfgtech.org), reveal that overall, demand through the first eight months of 2003 declined 16.1% to $1.2 billion from $1.4 billion during the same period a year ago (Figure 1).

FIGURE 1: TOTAL U.S. MACHINE TOOL CONSUMPTION

Bright Spot

According to NABE, the National Assn. for Business Economics (www.nabe.com), which presents the consensus of macroeconomic forecasts (made by a panel of 35 professional forecasters), of factors that might influence increased capital spending, 60% identified replacing aging equipment as the leading driver and 26% stressed the search for even higher productivity.

ARC's O'Brien says the replacement market is indeed a bright spot with a market approaching $65 billion over the next several years. "But don't look for wholesale manufacturing line or process train replacements, because manufacturers will only be replacing a little at a time." It appears that automation suppliers and machine builders in particular will need to articulate their migration strategy very clearly if they are to capture a significant part of this pie.

It is increasingly obvious that much of the diminishing amount of capital invested in plants and manufacturing/processing systems over the past 5-10 years went towards technologies that create efficiencies, boost productivity, increase output, and cut waste. Recent economic data is proving that this has been well worth the investment, and will continue to drive production-oriented capital spending in the near to mid-term. The effect of this general strategy continues to yield long-range dividends for manufacturers, and bodes well for machine builders and other production equipment suppliers--but more on that later.

IT: Emerging Key to Productivity

In the coming years, machine builders, process equipment vendors, and automation and controls suppliers will likely experience more growth on the "soft" side of the business, says IT industry analyst Michael Burkett, research director at AMR Research (www.amrresearch.com). He finds there is a sharp focus by manufacturers and processors to get more out of their capital equipment, and equipment vendors selling productivity-oriented IT technologies will find a lucrative market niche there.

"Lately there has been a shift," says Burkett, "away from wide-scope applications to technologies that integrate disparate IT technologies across the enterprise and the plant floor." He calls them "glue" technologies that integrate legacy systems and provide incremental productivity improvements. Thus, machine builders offering technologies that allow for online, real-time diagnostics or instant control software upgrades, for example, can create competitive advantage and likely increase their sales in spite of current market conditions.

"The technologies that are selling provide a clear migration path, identifiable ROI, and a positive shift in operational efficiency," says Burkett. The spending trend, he says, is most definitely toward systems and software that integrate production processes, remove steps in the work flow, animate or articulate a process, and identify waste.

Asset Management Spending

Connecting the dots for process industries, Sath Rao, industry analyst with Frost & Sullivan (www.frost.com), says, similar to the manufacturing industry, processing plant managers are clearly trying to do more with less. Spending in the 1990s clearly became directed toward optimization, advanced process control, and the selection of sensors and analyzers that yield better control over production. "The dominant focus for business in the beginning of this century," says Rao, "increasingly will be on maintaining and protecting asset investments." Any new investment has to be increasingly justified based on the improved return on assets it will yield.

Thus, vendors selling better production monitoring and control, data processing and network integration, equipment condition-monitoring, and other IT-based technologies that contribute to better, more efficient plant asset utilization, while driving down production costs and waste, have expanding global markets to look forward to. In a recently concluded Frost & Sullivan study "World Asset Management Market for Process Industries," market revenues for asset management technologies reached $734 million in 2003 and are forecast to grow at 10.6% CAGR, reaching revenues of nearly $1.5 billion by 2010. For machine and equipment builders selling in the process industries, this bodes well for future revenue expectations.

Productivity Driving Recovery

Most economists agree that productivity gains are essential because companies can pay workers more without raising prices (which can negate wage gains through inflation) which in turn, boosts consumer spending, accelerates economic growth, and contributes to healthier profits. Eventually, through productivity there is more capital to spend on production-supporting technologies.

Third-quarter productivity figures confirm that as 2003 drew to a close, U.S. workers put out more goods and services than most industrialized nations of the world. According to the U.S. Department of Labor's Bureau of Labor Statistics data released in December 2003, annual rates of productivity growth for the non-farm business sector in the third quarter were a seasonally adjusted 9.4%. In manufacturing, third-quarter gains were more dramatic: 9% (general manufacturing) and 14.8% in durable goods manufacturing.

The gain in durable goods manufacturing productivity was supported by an increase in third-quarter output per hour of 8.1%, the largest since the first quarter of 1971 when it increased 15.1%. And, while pay rose modestly (3.5%) in the durable goods sector, unit labor costs fell 9.9%, the largest decline in these costs since the second quarter of 2000, when the figure dropped 13%. This is good news because it means inflation remains under control.

Recession? What Recession?

At the end of October, the Commerce Department released preliminary Gross Domestic Product (GDP) figures for the third quarter of 2003, reporting that the economy grew at an astonishing 7.2% rate,the fastest since 1984. According to The Wall Street Journal, "Parsing the numbers a bit, we'd note that consumer spending kept up its end by rising at a 6.6% clip, the fastest pace in 15 years. But the better news is that business spending grew by 11.1%, the fastest rate since the first quarter of 2000 and a sign that the long-anticipated hand-off from consumers is taking hold. One month later, the news was even better when the Commerce Department announced that GDP had actually climbed by 8.2%, a full percentage point above the preliminary figure.

In the third quarter, chief executive confidence surged, according to the Conference Board's CEO confidence survey results released in early October (www.conference-board.org). The Conference Board's Measure of Business Confidence, which had improved to 60 in the second quarter of 2003, climbed to 67 in the third quarter (a reading of more than 50 points reflects more positive then negative responses). The survey covers approximately 100 CEOs in a wide variety of industries.

"The continued rise in CEO confidence is strong evidence of a turnaround in corporate performance," said Lynn Franco, director of the Conference Board's Consumer Research Center. Perhaps an even better portent of good things to come was her comment that followed: "This is also indicated by an improvement in capital spending plans."

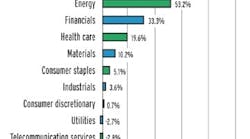

Corporate profits were also up for the third quarter with the Chicago Tribune and Bloomberg News reporting a rebound of early reported earnings by sector among Standard & Poor's 500 Companies (Figure 2). Leading the way were information technology and energy. Just before Thanksgiving, the Commerce Department reported corporate profits jumped 30% in the third quarter,the highest jump since 1984.

FIGURE 2: S&P EARNINGS BY SECTOR*

Manufacturing: Signs of Recovery

On November 3, ISM, the Institute for Supply Management (www.ism.ws), reported its manufacturing index increased from 53.7 to 57 in September (Table I). The October Manufacturing Report on Business, found that economic activity in the manufacturing sector grew in October, while the overall economy grew for the 24th consecutive month. Norbert J. Ore, C.P.M., chair of ISM's survey committee, offers this view: "The manufacturing sector enjoyed its fourth consecutive month of growth as new orders continue to lead the recovery. Production made a sharp swing upward during October, signifying growth for the sixth consecutive month."

Of the 20 industries in the manufacturing sector, says the ISM report, 14 industries reported growth: Leather; Instruments & Photographic Equipment; Food; Class; Stone & Aggregate; Tobacco; Paper; Fabricated Metals; Industrial & Commercial Equipment & Computers; Rubber & Plastic products; Chemicals; Electronic Components & Equipment; Primary Metals; Furniture; and Transportation & Equipment.

Late November figures from the Commerce Department support ISM's data, pegging a rise in orders for durable goods nationally at 3.3% in October, following a 2.1% rise in September.

Painful Climb From The Bottom

Will all of this spell better times ahead for industrial machine builders, capital equipment vendors, processing systems, industrial automation and controls, and IT? Time, of course, will tell, but September data on machine tool consumption released November 10 by AMTDA and AMT, offers the machine tool industry a bit of cautious optimism that things are heading in a better direction. According to the report, September U.S. machine tool consumption totaled $175.7 million, up 24.8% from August (Figure 1). Before anyone gets too excited though, that figure is down 9.7% from last August's total of $194.6 million and some 16% down over the same period in 2002.

"We are clearly seeing early signs of recovery in manufacturing," said AMTDA president Ralph Nappi in his remarks accompanying the report. "Both broad and specific indicators suggest we are at the beginning of a long and painful climb from the bottom." Commenting on a similar uptick (16.6% rise in August from July) about a month earlier, John Byrd, AMT's president, commented to Rueters reporters that even though consumption has lagged, "August orders and increased output among many of our customers appear to be signaling an end to the decline in manufacturing technology investments."

Semiconductors: Holding Pattern Lifting

In a report issued by Gartner (www.gartner.com) in July 2003, analysts forecast worldwide semiconductor capital equipment spending would return to positive growth in 2003. "After two difficult years," said Gartner analysts, "there are signs the industry has started to emerge from its holding pattern and has started to move forward again."

By early December 2003, SEMI, Semiconductor Equipment and Materials International (www.semi.org) confirmed Gartner's forecast announcing that equipment sales (chip manufacturing, testing and assembly) were expected to increase to $21.4 billion, more than 8% above the $19.8 billion in sales posted in 2002. The outlook for 2004 is even better with SEMI forecasting sales to climb to $29.6 billion a jump of 38.6% (Table II ).

Rising sales of semiconductors are also fueling the positive outlook for the industry. On December 1, SIA, the Semiconductor Industry Assn. (www.sia-online.org), reported worldwide sales of semiconductors rose to $15.4 billion in October 2003, a 6.8% increase from the $14.4 billion recorded in September, and a 23.3% rise from October of 2002. With the October 2003 gain, the strongest since 1990, industry revenue has grown 16.4% year to date.

"October is always a strong month for our industry, but this exceeds historical norms," stated SIA president George Scalise. "This growth cycle is dynamic and broadly-based, drawing strength from all geographic markets, all product sectors and all end markets, especially computation, communications, and global consumer."

Sidebar

Automotive Parts Capital Spending Flat

Every year Gardner Publications' research arm conducts a survey among a universe of 10,000 automotive design & production and modern machine shop plants in the discrete parts manufacturing industries (SIC 34, Fabricated Metal Products; SIC 35, Machinery; SIC 36, Electrical Machinery; SIC 37, Transportation Equipment; and SIC 38, Instruments) with more than 250 employees.

The "2004 Capital Spending Survey & Forecast" conducted from July 15-August 15, 2003 garnered a 16.1% response, and revealed that for the most part, plant spending on capital machinery and equipment will remain flat with 44% answering spending will remain the same. Respondents likely to increase spending fell a bit with 31.6% affirming such spending plans, down about 3% from reported forecasting plans for 2003.Nevertheless, the survey revealed plants in the industry plan to spend more than $12.2 billion in new, used, and rebuilt equipment in 2004 .