As the industrial hydraulic equipment market matures, electromechanical solutions such as electric drives are replacing hydraulics because they are more efficient, cheaper and available with shorter lead times. These factors have meant that not only was the hydraulic equipment market hit hard by the economic recession in 2009, but it is not likely to see much more in the way of recovery.

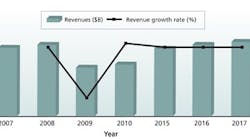

Frost & Sullivan (www.motors.frost.com) released a report recently, "European Hydraulic Equipment Markets for Industrial Applications," that estimates the market will grow from revenues of more than $1.4 billion in 2010 to more than $2 billion by 2017. Revenues dropped during the recession in 2009 by almost 32% to just over $1.3 billion, according to Frost & Sullivan. And despite manufacturers investing heavily in improving the reliability and performance of hydraulic equipment, 2010 revenues came mainly as a result of retrofits rather than new installations.

"Manufacturers have been integrating electronic controls with hydraulic equipment for increased accuracy and efficiency," said Sivakumar Narayanaswamy, program manager for Frost & Sullivan. "These improvements have played a significant role in sustaining the demand for hydraulic equipment." However, as technology continues to develop quickly in alternative motion control, many hydraulic equipment applications will likely be replaced by more effective methods, he added.

Hydraulic equipment has a large installed base, which will have to be replaced or repaired at some point. A key factor sustaining the replacement market has been leakage-related issues caused by aging and corrosion in hydraulic cylinders and accessories. Even during the slowdown, many end users postponed new installations and invested instead in repairs and replacements, the report explained.

"The use of hydraulic systems in mechanized processes is being threatened by the increased use of electrically operated drives and motors that offer accurate performance and reprogrammable digital control and settings, except in high-pressure applications," Narayanaswamy said. "Electrically operated equipment is able to meet customer demands for greater levels of accuracy and efficiency from automation apparatus."

The report also takes a look at the state of business in the market, noting that it will undoubtedly experience increased consolidation because of pricing pressures and competition from low-cost imports. Small and medium-sized organizations are unlikely to be able to withstand the competition from low-cost Asian manufacturers and decreased profit margins.

"Large multinationals are continuously looking to expand in terms of products and geographies," Narayanaswamy said. "This could compel small and medium-sized organizations to collaborate or merge with their bigger counterparts."