Despite the harsh winter weather and the resulting lackluster growth in the U.S. economy, business levels for manufacturers and suppliers of primary plastics machinery (injection molding, extrusion, blow molding, and thermoforming equipment) recorded another quarter of solid growth in Q1 of 2014.

According to statistics compiled and reported by the Committee on Equipment Statistics of the Society of the Plastics Industry, shipments of primary plastics equipment for reporting companies totaled an estimated $300.5 million in Q1.

The historical data shows that the shipments total typically declines in the first quarter of the year when compared with the fourth quarter of the previous year. Due to tax considerations and other budget-related reasons, the fourth quarter is usually the strongest quarter of the year for machinery shipments, and the first quarter is often the weakest. Nevertheless, 2014 is off to a good start. The total for Q1 of this year represented a robust gain of almost 11 percent when compared with the same quarter of 2013. For the sake of comparison, the total value for primary plastics equipment shipments in 2013 was up 8 percent when compared with the annual total from 2012.

PRIMARY PLASTICS EQUIPMENT SHIPMENTS

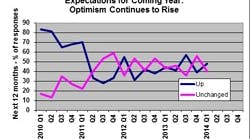

The CES also conducts a quarterly survey of plastics machinery suppliers that asks about present market conditions and expectations for the future. The responses from the Q1 survey were a bit more optimistic than they were in the Q4 survey, and they represent a continuation of the optimism that is broad-based across the industry. When asked about expectations for future market conditions, 93 percent of the respondents expect conditions to stay the same or even improve in the coming quarter, and 88 percent expect them to hold steady or get better during the next 12 months.