A year ago, we asked our readers about changes they’ve made in researching, specifying and ultimately buying their machine automation products and services [“How You Find Your Machine Automation.”]

A clear result of the study was evidence of the move away from more-traditional distributor relationships and tradeshow pilgrimages to a wider use of Internet tools.

We wanted to pursue some of these findings again, as well as move into other areas to explore. We’ll use the findings to get a better sense of how to build editorial content that helps you with these issues. It also gives you an opportunity to see how your buying habits are evolving compared with your peers, and it might help tell the supplier community what it needs to do to better serve your needs.

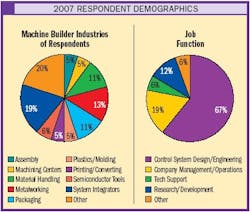

We sent study questionnaires to a representative sampling of our readers, and received more than 300 responses.

Machine Builders Still Make the Choices

Last year our respondents said they make the primary automation choices for their machines about 67% of the time, with customers making the decisions about 28% of the time. That seemed high. We asked the same question this year and got similar results—65% said they make those choices for their machines.

We broke out the larger machine segments among the respondents and this year found that the semiconductor tool makers say they make the automation decisions 80% of the time, with customers having the say 12% of the time. The remainder is made up of engineering and design consultants.

Builders of printing presses and converting machines were second, saying they make the automation choices 77% of the time, builders of metalworking machines checked in at 75%, material handling equipment builders were next at 65%, and packaging machine builders registered 62%.

The system integrators in the study say they make the decisions for their machine builder customers about 51% of the time, with the machine builder taking the responsibility about 40% of the time.

Doing What?

We again wanted to ask what types of projects were being explored when our readers started doing their research into products and services.

Respondents tell us that they’re spending 44% of their research time on active projects for next-generation machine controls to be implemented in the next six to 12 months. Compared with 37% saying this last year, perhaps it’s a sign of increased optimism among builders and manufacturers alike as they increase time spent on optimizing the means of production. It also could be a reality check that manufacturers know they have to optimize to remain competitive in a global arena.

As was the case last year, the respondents spend 22% of their research time looking for alternative suppliers.

The Search Leads to…

This year we expected to see a modest continuation of the trend towards more primary use of web-based research tools at the expense of local distributors and tradeshows.

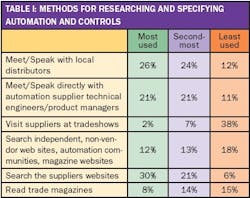

There was some movement in that direction, but not a statistically earth-moving shift by any means, and not at the expense of local distributors. Thirty percent of our study respondents say their most-used method of doing automation product research is searching vendor websites. Another 12% say their primary method is searching independent, non-vendor sites such as automation communities and portals like ControlDesign.com. The 42% total compares with 40% in last year’s study.

Respondents reported that meeting/speaking with local distributors as their most-used method 26% of the time, up from 24% last year. Meeting/speaking directly with the suppliers’ technical engineers/product managers was named the most-used source by 21% of respondents.

The least-used method of doing product research is tradeshows, as named by 38% of respondents. Eighteen percent of the respondents identified those independent websites as their least-used method, and reading trade magazines was named least-used by 15%. Table I provides more detail.

Deal Direct?

We wanted to go a bit deeper into a finding last year that said our respondents clearly would like to have more direct contact with supplier technical people, but cited frustration caused by a lack of availability of these experts.

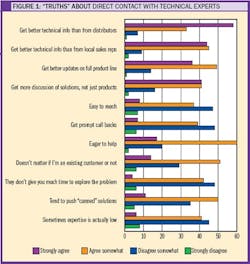

Figure 1 below summarizes what we found when we asked our participants to agree or disagree with various statements about the value, or lack thereof, that direct contact with vendor experts can bring.

A few results worth noting: 58% “strongly agreed” with the statement that they get better technical info directly from the vendor source than from local distributors. That number was 44% compared with local sales reps. But in both cases, the total that either “agreed strongly” or “agreed somewhat” was 90%.

A full 41% strongly agreed and an additional 41% agreed somewhat that they can have more of a solutions-based discussion with the suppliers’ technical experts.

While only 17% strongly agreed that the supplier’s technical experts were eager to help, a healthy 60% agreed somewhat that the experts were eager beavers.

On the flip side, more than half of the respondents either “disagree somewhat” or “disagree strongly” that the experts are easy to reach or that they receive prompt callbacks.

Even though we note above that the respondents believe they can get more of a complete discussion with the experts, half of the respondents agree somewhat (another 11% agree strongly) that the experts tend to push “canned” solutions at them.

Web Crawling

We asked our respondents to tell us, once they’ve decided to do their product and specification research on the web, where they start if they don’t have a particular brand in mind. The big winner still is Google; some 63% start there. Interestingly, that’s down a bit from 68% last year.

We also dove deeper into their beliefs and expectations about Google. A surprising 22% agree strongly and another 60% agree that first-page Google search results contain well-focused hits. That’s in contrast to 28% who agree strongly and another 50% who agree that the top results on the list simply are bought and paid for and appear regardless of their actual relevance.

The respondents also agree or agree strongly that too many of the returns are vendor-biased product plugs (47%/21%), are outdated information (51%/10%), and have nothing to do with what they’re looking for (58%/19%).

As a sign that there’s great opportunity for portals such as ControlDesign.com to help our readers with better technical search, 55% agree and 27% agree strongly that “it’s a lot of work to go through the [Google] list, but there’s no better web-based research tool for me at this point.”

Vendor Sites

While a significant number of the respondents begin their search at supplier websites first, they’ll likely need to visit multiple vendor sites for a representative sampling. Forty-four percent report that they visit two or three sites to do their research. Another 38% need a broader look: they visit four to six sites, while 13% visit up to 10 sites to do what they consider thorough research.

We received wide and varied responses about what, based on their actual experiences, makes a supplier website good or bad. Out of the hundreds of comments, there’s near-unanimity that good supplier sites have to be easy to navigate, contain plenty of easy-to-find technical details, and have downloadable product manuals, schematics, and other references. Many of the respondents visit sites where they find complete, uniformly presented specifications, so they can do product-to-product and vendor-to-vendor comparisons.

“The ability to get technical information on their products with ease is the #1 most important experience when I’m specifying parts,” says the engineering manager of a stone-cutting machine builder in the Rocky Mountain region. “If it’s too hard to get, I’ll just move on to the next supplier.”

“A good website has a user interface that quickly and intuitively teaches a visitor about the specific terminology used by the manufacturer for its products,” says a chemical engineer at a coating equipment builder in Wisconsin. “Live chat can be very useful if the feature is staffed with knowledgeable support personnel. For example, Microsoft does an excellent job of using live chat for helping to specify business software.”

Many note frustration with sites that are teases. They provide only so much information, then make you contact someone or register for more.

A number of the respondents said that some sites make it hard to find a product unless you have a part number, and some have “links that don’t work—a sign that the vendor really doesn’t care about helping you.”

There’s no value in naming names here because one person’s bad site sometimes was another’s good one. But it’s very clear that the respondents had a much easier time naming sites they don’t like, compared with those they do.

Buying Online

We wanted to know how far the movement toward actually buying automation and control components online has progressed in the industrial machine builder community. One-third of the respondents say they buy online via a manufacturer’s website, a percentage point more than those who say they buy from online catalog stores.

There’s some selectivity here. The majority of the respondents were consistent (i.e., if they bought online directly from the manufacturers, they bought from online catalog stores as well). But 35% of the respondents who buy online from the manufacturers don’t use online catalog stores. Similarly, 38% of those buying via online catalog stores don’t purchase online directly from manufacturers.

Many of those who responded “no” indicated that they do most of their research online, but they still prefer to buy locally or are bound by a company policy that still prohibits it.

The most frequently mentioned manufacturers that respondents buy from online were Rockwell Automation, National Instruments, and Omega Engineering. Among catalog stores AutomationDirect, EZAutomation, Grainger, McMasterCarr, Allied Electronics, and Newark Electronics were mentioned more frequently than others. These results should not be considered statistically significant, as many responders answered “various” or chose not to identify their sources.

Decision Making

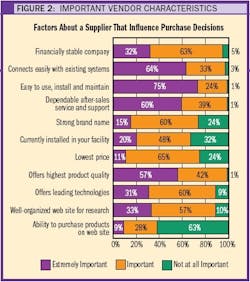

Regardless of where you buy your products, the criteria you use to make those choices is the paramount issue. Figure 2 below summarizes how the study respondents evaluate the importance of various factors in their purchasing decisions.

The factors more often identified as extremely important are “easy to use, install, and maintain,” followed by “connects easily with existing systems,” and “dependable after-sales service and support.”

Lowest price was an “important” factor for 65% of the respondents, but only 11% considered it extremely important. Along those lines, 48% of the respondents found it important that a product by already installed in their machines, but only one in five thought this to be an extremely important purchasing factor.

While 90% of the respondents deemed a well-organized supplier website extremely important (33%) or important (57%) for doing research, 63% said the ability to purchase online was “not at all important.” That factor was by far the least important to our respondents.

The New Information Thing

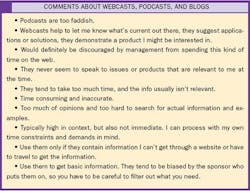

Part of our job is to try to deliver information in a way that helps you research and specify your machine controls. We also have to try to evaluate and anticipate your affinity for newer types of information-delivery vehicles. That would include web casts, audio podcasts, and web logs (blogs).

We had little other than anecdotal evidence about your use and the value you place on these types of information systems. Perhaps more importantly, we’ll begin to track the trend over time to develop more hard information.

This year, only webcasts showed any affinity, with 38% saying they’ve used them on the job. Podcasts barely blip the radar screen, and one in eight responders use blogs in their jobs. A suggestion that blogs conceivably could become an information source for machine control professionals is indicated by the finding that one in six use blogs for non-job issues.

The comments are wide-ranging. Among that 38% who say they’ve used webcasts on the job, a rough tally based on their comments indicates about 30% like them and find them helpful, while 40% found the content or the technology lacking. The remainder hadn’t formed an opinion yet.

Most of the negative or dismissive comments can be summed up simply: these methods are viewed as having biased, irrelevant information that’s too time consuming for the value they might offer. These two comments summed up much of this sentiment: “No time for webcasts or podcasts,” says a New England HVAC system builder. “If they are live, scheduling them is difficult. If they are offline, it takes too long to play through to get useful information. Let me do my Google search when I need to find something specific.”

“The webcasts I’ve participated in have been slow, low-quality audio, and lacked a depth of information,” said the supervisor of technical services for an Illinois heavy equipment manufacturer. “It seemed the item on display was the webcast, not the product I wanted to learn about.”

Among the group that liked them, these comments nicely sum up the sentiments:

-

“I think a well-done webcast can be very helpful, but many of them aren’t well thought-out,” says a system integrator from the Midwest. “The bad ones make you leery of signing up for the next webcast you see.”

-

“Webcasts are an efficient method of giving a training class or presentation,” says a controls specialist for a southwest material handling system builder. “Busy ‘students’ need not travel with the associated expense, or take much time out of their schedule. Likewise, you can allocate an expert for this focused class where they might otherwise be unavailable. You’re not limited by space [or other constraints].”

-

“They’re useful because of the convenience of exposure to new information without blocking out time for travel,” says an unidentified respondent. “If I find the information has little relevance to me, I can excuse myself or divert part of my attention to other things.”

-

“I use webcasts for detailed presentations when confusion about potential solutions is present,” says the engineering manager of a New England-based builder of direct imaging digital printing presses. “It’s convenient to have all the decision makers see the same presentation without a significant scheduling issue.”

There is so little exposure to audio podcasts in the respondent group, the only comments rendered shed no light on whether they’ll grow in affinity.

The value of blogs generated comments, not surprisingly, at polar extremes. “Blogs have too many unsubstantiated or incorrect statements,” says the president of a rolling mill building company in Indiana. Similiarly, “Blogs tend to be emotional rants, whether for job-related discussions or for non-job topics,” says the president of a system integrator house in Georgia. “However, sometimes a pearl can be rescued from the swine.”

On the positive side, “Blogs give customer feedback in a type of forum environment,” says a rolling mill builder in Michigan. “Nothing speaks more than a satisfied/dissatisfied customer.” And further, “Web logs give practical, sometimes useful, but often real-world product information that’s not as biased as a sales release,” believes a senior electrical design engineer for a Great Lakes area builder of packaging lines for the paper industry.

Leaders relevant to this article: