How the Control Design audience researches, specifies and buys machine automation products and services is the subject of research we conducted earlier this year to determine whether the habits of this population are changing in these endeavors.

The first two years of this annual study confirmed the steady migration away from more-traditional distributor relationships and trade- show trips to a far wider use of Internet-based tools.

This year, we looked into some of those areas again to see if things are still changing and added other areas of this subject to explore. We use these findings to get a better sense of how to build content that helps you with these issues. It also provides something of a snapshot of how your buying habits are evolving, compared with those of your peers. In previous years, it has pointed out issues that the supplier community needs to pay heed to in order to better serve your needs.

Calling The Shots—More Than Ever

In 2006, our respondents said they make the primary automation choices for their machines about 67% of the time, with customers doing so about 28% of the time. That seemed high. We asked the same question in 2007 and got similar results—65% said they make those choices for their machines.

We repeated that question this year and, once again, 64% of the machine builders say they make the decisions, with customers calling the shots about a quarter of the time.

We asked system integrators the same question and found when they’re involved in a machine automation project, they make the automation decisions about half the time, with the machine user doing so about one-third of the time.

There wasn’t a great deal of variation in these responses among the various machine builder market segments participating (see demographics breakdown).

Change Partners

This year we asked the study participants about the stability of their supplier relationships. Anecdotally, it seems that suppliers and users want to establish lasting partnerships.

This was the most surprising finding this year. Fifty-two percent said they changed primary suppliers for one or more product categories in the past year. About one-quarter said they’ve changed primary suppliers for controllers, I/O, sensors/measurement and motors/drives (topped the list at 27%). Some 16% said they’ve changed their primary supplier of mechanical components, while 17% changed OI/HMI suppliers.

Given the level of churn, we surely wanted to know why (Figure 1). Of those who changed suppliers for at least one product category, 29% cited product quality and performance problems. Price was cited by 22%. And a discontinued product line was noted by 20% of the respondents.

The Search Leads to …

Each year we ask about our participants’ primary method for doing product research. We expect a continuation of the trend toward more use of Web-based research tools at the expense of local distributors and trade shows.

Meeting/speaking with local reps and distributors stayed statistically constant at 25% this year from 26% in 2007 and 27% in 2006. Figure 2 summarizes these findings.

In Your Face to Face

We wanted to follow up on evidence that said our respondents want more direct contact with suppliers’ technical people and cite frustration due to a lack of availability of these experts.

Figure 3 indicates what we found when participants agreed or disagreed with various statements about the values that direct contact with vendor experts can bring.

A clear 63% strongly agreed they get better technical information directly from the vendor source than from local distributors. But only 38% strongly agreed it was better than information from local sales reps. In both cases, the total that agreed strongly or somewhat exceeded 90%.

A full 42% strongly agreed and an additional 39% agreed somewhat that they can have more of a solutions-based discussion with the suppliers’ technical experts.

While only 16% strongly agreed that the supplier’s technical experts were eager to help, a reassuring 54% agreed somewhat that the experts were eager to please.

A new question this year finds that nearly four in 10 admit that part of the problem in successfully working directly with the experts is that they themselves are guilty of being non-responsive to the manufacturers’ advances.

Search and Annoy

Once these respondents decide to do their product and specification research on the Web, where do they start if they don’t have a particular brand in mind? The clear destination is Google, but the trend continues to drift down: 60% this year, 63% last year and 68% in 2006.

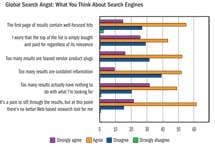

It appears that the frustration of trying to do technical search via this type of search engine is growing. Looking further into their beliefs about and expectations of Google, Yahoo and other search engines, 14% agreed strongly and another 55% agreed that first-page search results contain well-focused hits. Those numbers were 20% and 60% last year.

The respondents also agreed (48%) or agreed strongly (32%) that too many of the results have nothing to do with what they’re actually looking for. Nineteen percent agreed strongly last year.

As a continuing sign of great opportunity for portals such as ControlDesign.com to help engineers with better technical search, 62% agree and 22% agree strongly that “it’s a pain to sift through the results, but at this point there’s no better Web-based research tool for me.”

Vendor Site Seeing

The largest segment of respondents begins its search at supplier web sites, and many visit multiple vendor sites to be satisfied they’ve seen enough. Fifty-one percent said they visit two or three sites to do their research. Another 36% need to visit four to six sites.

There’s a wide range of responses, based on actual experience, as to what makes a supplier web site good or bad. The hundreds of comments distill down to a few no-brainer basics that visitors want: be easy to navigate, have easy-to-find technical details, and offer downloadable product manuals, schematics and similar references, as well as price lists they can trust. Many of the respondents want to find complete, uniformly presented specifications, so they can do product-to-product and vendor-to-vendor comparisons.

Respondent Demographics

|

The number of complaints about sites not providing this seemingly basic help is significant and is most often accompanied by a reaction that they’re being marketed to, not helped.

Two prevalent complaints involved “finally seeming to find the area you were looking for only to be asked to register or fill out a ‘contact me’ form.”

When it’s good it’s good: “We are a very small company,” says another respondent. “We mostly buy motors, drives and other control components through established local distributors, but we greatly value web sites, which provide complete engineering and product specification data and allow us to buy all our software, communications adapters, accessories and simulation software online.”

Practical applications were on the wish list: “All product vendors would benefit by providing user examples with their content. Many times, after I review an example, I can properly decide if this is the right product for me.”

Buying Online?

With your stated move to more use of online research tools, we anticipated finding some corresponding increase in the number of controls professionals who buy automation and control components online. We actually found a decline compared with the 2007 findings. Only 19% of the respondents said they buy online via a manufacturer’s web site, while 21% said they buy from online catalog stores. The number was about one-third in both categories last year.

The most frequently mentioned manufacturers that respondents buy from online were nearly identical to last year, with Rockwell Automation, National Instruments and Omega Engineering mentioned most often. Among what the respondents identified as catalog stores, AutomationDirect, EZAutomation, Allied Electronics and Newark Electronics were mentioned more frequently than others. This result is not statistically significant because many responders answered “various” or didn’t identify their sources.

Decision Making

The study respondents evaluated the importance of various factors in their purchasing decisions. The factors most identified as extremely important were “easy to use, install and maintain,” followed by “dependable after-sales service and support,” and then “connects easily with existing systems” and “offers highest product quality.”

Lowest price was an “important” factor for 48% of the respondents, but only 13% considered it extremely important. The most ambiguous result here showed 40% finding it important that a product already be installed in their machines, and 14% considered it an extremely important purchasing factor. Forty-six percent disagreed, calling it a “not very important” factor.

All About Delivery?

Our job as a content provider is to deliver high-quality information in ways that best help machine control professionals research and specify products and services. We have to try to evaluate and anticipate your affinity for newer and emerging methods of information delivery beyond a print product.

Until last year, we had little more than anecdotal evidence about the value you place on information-delivery methods, such as webinars, video, podcast/MP3 downloads, online forums and blogs, but more importantly whether you use any of them to help you do your job.

As we continue to track usage, we’ll begin to sense trends in your affinities or lack thereof to these methods. This migration to embracing “different” content-delivery methods still is a slow work in progress (Figure 4).

The one medium clearly perceived as the most worthwhile of the bunch is forums/bulletin boards. This year, 14% of respondents said they use the medium weekly, and 41% use it monthly. That’s far better than any of the others we asked about.

“Forums provide the opportunity to send your question to many people—experts, novices—and maybe some of them can help,” says a respondent. “The probability is that more than one person has had the type of problem I have.”

Another respondent says he likes “the almost unrestricted sharing of knowledge on many issues concerning my job as a control automation engineer.”

One in 20 responders said they use webcasts weekly in job-related activities. Another 16% said they use them monthly. That’s hardly an endorsement, but you might argue there’s some curiosity about them, as another 38% said they use them on rare occasions/no more than a few times a year. A quarter of the respondents never use them at all.

“They are quick, no lost travel time and informative,” is one comment. “If the topic isn’t appropriate, I just disengage.” Another responder says he uses webcasts from time to time to be able to see a demonstration of a product without having to leave the office.

On the other side, “podcasts and videos take too long to extract content,” says a participant. “You can’t speed-read them. I can read or reread faster than someone can speak or have to re-cue to review … would prefer to read as opposed to watch/listen.”

A perceivable theme among those thinking well of webcasts is a preference for product demos, not industry issues.

Podcasts/MP3 downloads of interviews with vendors or machine builders barely have a pulse again this year. Less than 8% make use of these podcasts/MP3 downloads at least monthly. About half of the respondents said they never use them at all.

Videos might show some promise, although the responses are an emergent data point we didn’t ask about last year. However, 23% of the respondents say they use this medium at least monthly, in particular vendor-created videos about products. “I really like vendors who have videos on how to configure and deploy products,” reflects the thoughts of many respondents.

Blogs showed some life compared to last year, when 12% said they used them in job-related activities at least once. This year, we discussed information delivery and frequency. We found 7% use blogs weekly, and another 19% use them monthly. As with webcasts, there might be some curiosity that could turn into more interest: 30% say they’ve on rare occasions visited a job-related blog.

“Most vendor videos and many webcasts and podcasts are flash sales pitches with too little engineering info to be worth my time to watch,” is a pretty typical reaction. “Same goes for most forums and blogs. Lots of time and effort to get very little benefit.”

Another says, “Yes, you must accept that many of the listed responses are very biased. But the nature of the discussions and the types of questions presented serve to offer important information about a product and the organization behind it.”

It seems that there’s a loose confederation of engineers out there that thinks its best bet for unbiased Internet-based opinion is the forum, but they’re wary of an inherent bias/agenda in bloggers.

Among those who don’t have any use for these tools at all, it’s easy to summarize the comments. The clear belief, experienced or presumed, is these types of material are too much commercial, contain too much bias and don’t provide enough real user help.

It’s likely that viral marketing will make these media grow into a valuable user tool. This comment summarizes a few others: “I won't go looking unless there's some evidence they help. If a fellow employee recommends one, maybe I'd have a look.”

Doing What?

With all this activity going on, we asked what types of projects were being explored when our respondents did their product research, whatever the method used.

Identical to last year’s result, the respondents told us that they’re spending 44% of their research time on active projects for next-generation machine controls to be implemented in the next six to 12 months.

Similar to last year, the respondents spend 21% of their research time looking for alternative suppliers and less than 7% checking up on their competition.

Leaders relevant to this article: