Foreign Trade, Energy Costs Highlight 2008 Hesitancy

By Mike Bacidore, managing editor

A good crystal ball never seems to be around when you need one. The uncertainty of the U.S. financial markets coupled with a coy and fickle supply of energy makes for an uncertain 2008.

But manufacturers, and specifically machine builders, are resolute in their intentions for the new year.

Bank of America’s 10th Annual Manufacturing Sector Outlook, a yearly survey of CFOs at U.S. manufacturing companies, indicates that the big push for 2008 is in foreign markets.

“With healthy balance sheets, manufacturing CFOs look for and find ways to grow their businesses, whether organically through M&A or expanding internationally,” says Bank of America Business Capital President Joyce White. “Strong U.S. exports certainly contribute to an expectation among manufacturers that revenues and profits will continue to increase through 2008.”

The weak dollar translates into strong opportunities to sell into markets abroad.

“We’re providing products with lower cost of acquisition, lower cost of ownership and higher productivity,” says Laurence Dunn, chief engineer of the Innovation Group/Electric Truck Division at NACCO Materials Handling Group (nmhg.com), Fairview, Ore. “2008 will be good for U.S.-manufactured products, but poor for European and other foreign manufacturers because of currency exchange issues.”

The U.S opportunity to capitalize on the world economy already has received a lot of play, but it’s a catchy outlook that sticks in your head like a snappy tune that everyone is humming.

“The currency exchange rate favors North American manufacturers considerably, and PMMI expects this to continue in 2008, making U.S.- and Canadian-made equipment a very strong value,” says Charles Yuska, president and CEO of the Packaging Machinery Manufacturers Institute (pmmi.org). “This might be a considerable silver lining for U.S.- and Canadian-based companies.”

PMMI’s research indicates a 3% growth rate in 2007 for the $6.1 billion market. “To put that in perspective, the packaging machinery industry experienced 6% growth in 2006, 8.4% growth in 2005, 7.6% in 2004 and 9.8% growth in 2003,” explains Yuska. “We expect sales to moderate.”

SEMI Perspective

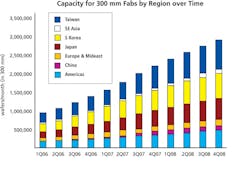

Nowhere is the sound of international trade louder than in semiconductor manufacturing. Japan has led the industry in semiconductor equipment spending over the past five years, and Asia remains a key region for investment in final manufacturing, according to research from SEMI (semi.org), whose Capital Equipment Consensus Forecast projects 2007 sales to reach $41.7 billion. Following 23% market growth in 2006 and 3% projected growth in 2007, survey respondents expect the market to decline about 2% in 2008.

Asian territory

Investment in 300 mm technologies is the primary driver behind Asian spending on new semiconductor equipment.

“Sales of semiconductor manufacturing, testing, assembly and packaging equipment are at levels slightly above last year, and will result in 2007 being the industry’s second strongest year on record,” says Stanley Myers, president and CEO of SEMI. “SEMI members have continued to generate strong overall sales of chip manufacturing equipment, and expect to see a $48 billion dollar market by 2010.”

The Japanese market expects to realize a 3% decline in 2007 and move behind Taiwan for only the second time ever. South Korea also continued its expansion in 2007, with growth projected at about 5%. Sales of new equipment in China will grow almost 24%, due somewhat to Japanese semiconductor manufacturers relocating assembly and testing plants to China, according to SEMI’s report.

SIs Staying the Course

The outlook for system integrators doesn’t appear rosier, but Viewpoint Systems is committed to its long-range plans. “We see most businesses pulling back and being real conservative on new projects, almost weathering an upcoming storm,” says Stu McFarlane, vice president, Viewpoint Systems (viewpointusa.com) in Rochester, N.Y. “Another sentiment we hear a lot is the expectation of previous investment to start paying off.”

Viewpoint Systems specializes in measurement automation and control, partnering with product development and manufacturing companies. “Our expertise covers test software and systems, custom electronics instrumentation, real-time control and data management,” says McFarlane. “We are investing in a vertical, nationwide market for technical test data management. It may not be the best time to do it, but we are committed at this point and will continue to invest. We’re also looking for modest growth in our general purpose business in the coming year.”

Just One Word: Plastics

While 2007 slowed for the plastics industry, the horizon looks bright by the end of 2008. U.S. manufacturers and importers of primary plastics machinery and equipment shipped $228 million worth of primary machinery in the third quarter of 2007, down 11% from the previous year, according to the Society of the Plastics Industry (plasticsindustry.org).

“Plastics processors continue to struggle with the high cost of resins and energy, and this has hindered their ability to invest in new equipment,” says economist Bill Wood, who provided the analysis for SPI’s quarterly machinery shipment statistics report. “Plus, total demand for plastics products remains hindered by the sharp declines in both residential construction activity and domestic auto production. The energy issue notwithstanding, other important indicators portend slow but steady improvement in the U.S. economy and the plastics industry in 2008.”

The Complete Package

From a macro perspective, there’s a lot of data pointing to a more challenging business climate, says PMMI’s Yuska. “The business media are reporting drops in consumer confidence, lower spending on goods and the documented problems in the mortgage and housing sectors,” he adds. “If economic conditions lead to a marked decrease in consumer spending, then we would expect consumer goods companies to follow with reduced investments in capital equipment.”

Being an election year, 2008 will will slow as the U.S. economy waits for direction on future policy plans. That means proactive machine builders will have the upper hand, explains Yuska. “We would absolutely expect a strong industry focus as suppliers get in front of customers to determine their growth plans. We also expect a continued focus on delivering as much value as possible to customers through a ‘total systems solutions’ approach to the market. Customers continue to look for a system, rather than individual machinery, when they are investing in capital equipment.”

MERGERS, ALLIANCES, AND ACQUISITIONS

THE VALUE ENGINEERING ALLIANCE (the-v-e-a.com) formed a strategic alliance with the DTI-NanoTech division of Discovery Technology International (discovtech.com) to drive the development, implementation and acceptance of nanopositioning systems.

BEIJER ELECTRONICS (beijerelectronics.com) acquired industrial data communications company Westermo of Sweden.

FERRAZ SHAWMUT (ferrazshawmut.com) acquired General Electric’s Power Fuse operations from GE Consumer & Industrial.

BALLUFF GMBH (balluff.com) of Neuhausen, Germany, acquired SIE Sensorik Industrie GmbH, a capacitive sensors company.

Pepperl+Fuchs (pepperl-fuchs.com) will be the fieldbus interface and PC operator terminal supplier, partnering with Emerson Process Management (emersonprocess.com) on GE Healthcare’s Lindesnes plant in Norway.

DALSA’s (dalsa.com) IPD Vision Appliance products have been approved for participation in the Rockwell Automation (rockwellautomation.com) Encompass Program.