Machine Safety: Burden or Improvement?

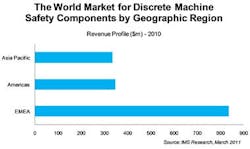

Suppliers have been telling machine builders that safety components are not a cost burden, but rather a means to improve their machinery—to improve productivity and improve downtime. It would appear that machine builders are beginning to agree. With a shift in thinking, IMS Research expects global revenues for discrete machine safety components to exceed $2.15 billion in 2015, up from $1.5 billion in 2010, according to a new report.

Granted, machine builders and end users are also working to come into compliance with the latest safety legislation. Until the end of this year, for example, machine builders can comply with either the old EN 954-1 standard, or with one of the new standards: EN ISO 13849-1 or EN IEC 62061, explains Mark Watson, research manager at IMS and author of the report. By the end of 2011, however, they must make a switch to one of the new standards, he says.

“That’s quite a big change going on,” Watson says. “Machine builders are seeing this transition as something that’s going to cost them money.”

But they’re beginning to come around to the suppliers’ way of thinking, realizing that the trend toward more intelligent safety components (more likely than not networked, Watson notes) can limit downtime and improve efficiencies. Component companies are looking for more ways to integrate diagnostics, looking for failures before they happen. Some examples include switch interlocks or guards on doors, where they’re integrating diagnostic indicator lights, Watson says. “They’re looking for anything where they can limit shutdowns by giving the components more intelligence.”

Although the EN 954-1 standard is easier and cheaper to work with, it did not sufficiently consider programmable electronic systems or the failure probability of components, and it is commonly considered deficient for use with complex or very hazardous equipment. The two new standards, on the other hand, are based on the concept of functional safety, and consider all safety-relevant functions and areas of a machine.

“As discrete machine safety components have become more intricate and used in more complex applications, new standards are required to define emerging technologies and components,” Watson says. “The benefits here include a wider adoption of programmable safety components, faster identification and rectification of safety-related problems, and increased productivity due to reduced downtime.”

EN ISO 13849-1 and EN IEC 62061 also are both globally recognized international standards rather than just European. This makes it easier for machine builders to adhere to standards no matter where they are selling, without having to make regional changes, Watson notes.

Suppliers are improving ruggedization of their safety components as well, Watson says, noting increase protection against dust, water and shock, and the use of more solid-state components so that the machinery isn’t shut down accidentally.

And safety is working to keep up with the speed of automation. “The speed’s increasing, but it still needs to be safe,” Watson says.

One way to achieve this is to integrate safety with standard control components. “It’s much more of a focus now, particularly from the larger automation component suppliers. Siemens and Rockwell have just one PLC looking at the safety side and standard control.” The same is happening on the networking side, he adds, with B&R Industrial Automation, for example, pushing safety buses as part of the standard automation control network, so there are no issues with compatibility. “I think that will only increase,” Watson says.