EU automation market stressed from Chinese competition

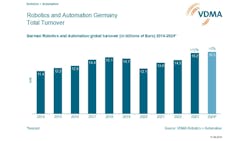

The European market continues to stress suppliers’ financial projections. Robotics and automation in Germany will be mostly driven by foreign demand in a subdued domestic economy: The industry is forecasting an overall increase in sales of 2% to 16.5 billion euros in 2024. In the previous year, companies achieved a record of 16.2 billion euros with a 13% increase in turnover.

“The robotics and automation industry is treading water in a weak domestic economy,” said Frank Konrad, chairman of VDMA Robotics + Automation. "Uncertain customers are reluctant to invest. The German economy needs better framework conditions so that we can return to a solid growth path. The industry is expecting some momentum from overseas business in 2024 as the incoming orders rose by 21% in the first four months."

China sets its sights on Europe

International competition for the German robotics and automation industry is likely to intensify in the future due to the increased focus of Chinese competitors on Europe. China is one of the most advanced economies in the world when it comes to industrial automation: according to the most recent IFR data, robot density in the manufacturing industry rose to 392 units per 10.000 employees, on a par with Japan (397 units) and Germany (415 units). Beijing is also specifically promoting its own high-quality Chinese robotics industry as part of its five-year plans. The trade disputes with the United States mean that Chinese companies will increasingly establish local service and sales structures in Germany and the EU.

Germany needs speed

“Politicians have recognized robotics and automation as a key technology for Germany's competitiveness,” said Konrad. “But now the pace of implementation needs to pick up. Germany needs a reliable framework for investment and new measures in order to strengthen its competitiveness.”

The VDMA strategy paper “Robotics and Automation 2028” makes recommendations and provides guidance for this. The proposed actions include industrial policy measures, accelerated innovation, the promotion of talent and a pragmatic approach to regulation.

VDMA

The VDMA represents more than 3,600 German and European mechanical and plant engineering companies. The companies employ around 3 million people in the EU-27, more than 1.2 million of them in Germany alone. This makes mechanical and plant engineering the largest employer among the capital goods industries, both in the EU-27 and in Germany. In the European Union, it represents a turnover volume of an estimated 910 billion euros. Around 80% of the machinery sold in the EU comes from a manufacturing plant in the Single Market.

The VDMA Robotics + Automation Association (VDMA R+A) is a trade association within the umbrella of the VDMA with more than 400 member companies: Suppliers of components and systems from the fields of robotics, integrated assembly solutions and machine vision. The aim of this industry-driven platform is to support robotics and automation through a wide range of activities and services. Key activities include statistical analysis and market surveys, marketing activities, standards development, research, public relations, trend studies, trade fair policy and networking events and conferences.