What’ll it take to put you into this machine today?" Though it’s a variant on the old car dealer cliché, this basic question never is far from the minds of industrial machine builders and their customers. Ever-present pressure to increase production and efficiency continually drives users to seek better machines, and forever pushes builders to design and develop them.

However, many machine builders focus so intensely on technology that sometimes the financing needed to deploy a big-ticket machine on a plant floor seems to be almost an afterthought.

"We don’t understand enough about the power of finance," says Randall Harland, sales vice president for machine builder Mori Seiki, which has a small portfolio of leases with some longtime end users. "We know we have competitors with in-house financing, and we need to build similar capabilities. We’ll get there, and will have opportunities when we do. However, because we’re a machine builder, leasing and financing still are seen as marketing concepts, even if they do help users." Harland adds his former company, Machinery Systems Inc. of Schaumburg, Ill., does more leasing and financing because it’s a machine distributor.

The relative prevalence of leases among machine builders seems to be a combination of industry tradition, application type, company size, and/or machine longevity. One or more of these factors seem able to convince some builders and potential customers to seek the advantages that leases can give them. These benefits typically include giving users access to performance features they couldn’t afford otherwise, not tying up too much cash in hardware they might not be able to resell, and limiting a machine’s presence on a balance sheet for depreciation and tax purposes. These benefits give builders more ways to gain sales and revenue.

Though end users and builders enter into leases to widely varying degrees, increasing global competition and shortening machine lifecycles might be inspiring more industrial OEMs to reexamine leasing as a useful option. "Most machine tool builders and distributors obviously would like buyers who just come in and write them a check, but many find that leasing is just another good arrow to have in their quivers," says Bill Colwick, senior vice president of National City Manufacturing Finance, which sets up leases for machine tool builders and industrial users.

Economic Undercurrents

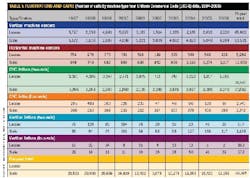

Though leasing has grown along with machine tool sales in recent years, both suffered previous declines as well, according to research by Equipment Data Associates of Charlotte, N.C. (See Table I below).

Of course, the 9/11 attacks triggered many economic drop offs, including steep reductions in machine tools leases and sales. However, leases began to slip earlier due to a federal capital-expensing allowance program in 2000-04, which allowed many users to expense the first several hundred thousand dollars of new equipment they bought. "This had a big impact on smaller companies, but since then leases have bounced back to about 30% compared to sales," says Patrick McGibbon, the Association for Manufacturing Technology’s strategic information and research vice president. "In fact, there’s still an incentive for small companies to buy machine tools instead of lease because they still can expense them at a higher rate."

Colwick adds that, "Overall, we’re now seeing adoption of more types of leases because business is strong. Four years ago, manufacturing was really straining after 9/11. Business and profits were down sharply, and so we saw more true leases because users didn’t need any extra depreciation. It was better then to have lower payments than the depreciation that goes with ownership. As the economy improved and profits increased recently, demand for some of leases decreased, while other types of financing made gains."

A History of Partnerships

While many builders are unfamiliar with leasing, FMC Food Tech, Lakeland, Fla., has been building and leasing machines practically ever since it invented the bean sprayer in 1886 and then its citrus juice extractor in 1942. Since its machines often had to be trucked out to remote agricultural sites to perform traditionally season work, leasing appears to have been a natural strategy, and is still how it conducts most of its business. Today, FMC’s five-headed extractors run at 120 rpm, and can process 600 pieces of fruit per minute (See Figure 1 below). The company has more than 2,000 machines operating worldwide, including a few facilities with 200 machines, and the largest in Florida, which has 76 machines.

FMC Food Tech leases so many machines, such as this citrus juice extractor, that it provides some users with 24/7 onsite support as well.

"We lease enough machines and subsystems at these sites that we can offer 24/7 support onsite, and make sure our customers have the optimum equipment they need, as well as the latest improvements," says Keith Bunce, FMC’s citrus systems controls manager. "This means our users don’t have to worry about the costs of spare parts or having the right component mix."

Bunce adds that FMC’s leases start with a flat possession rate for its core machines, and then adds a box rate for each crate of fruit processed. This rate includes a discount that increases as more fruit runs through the machine. "Because leasing ties up FMC’s capital, it’s in our interest to make our users as efficient as possible," explains Bunce. "What we end up with is much more of a true partnership than a simple lease."

Besides training users to operate its machines, FMC also leases automation software that allow users to access its programmers and other experts. The builder also uses a virtual private network (VPN) to provide even more support. In fact, several FMC systems in Belize, China, and California now are supported remotely from its Lakeland facilty. "We did a lot of Belize’s programming and startup work from Lakeland, and remotely added a pulp system and modifications for the California processor," adds Bunce. "We even managed a processing plant project in China, and did all the modifications, menu management, and recipes from Florida.

"Our role as a lessor is to make our customers outperform their competitors. We’re more than a vendor because we know enough about our users’ businesses to keep them successful. The leasing model gives us incentives to continually upgrade and support our products, and to make sure our customers are running at the highest levels of efficiency."

Independent Leasing

Some machine builders get so good at leasing that they began to wonder why they can’t take over the financing too. However, very few actually do it. One of these pioneers is machine builder Haas Automation, Oxnard, Calif., which established a "dedicated finance program" in 1993 (See Figure 2 below). CNC Associates Inc. usually helps end users who are just getting started. Unlike many machine builders that lease through private-label agreements, which looks like a builder but is really a bank, CNC is a separate leasing company. The company says its independence gives it more freedom to help lessees when problems arise, unlike banks whose main recourse priority is to get their money back immediately. Likewise, CNC also benefits by using Haas’ distributor network to remarket equipment.

"It’s not easy for a small shop to go out and get the $60,000 they need for a machine. We try to support these folks, and give them a chance to make a go of it," says Justin Snyder, CNC’s operations manager. "Our founder, Gene Haas, really understands the challenges and frustrations of a start-up business because hehad been in that position himself. So, he asked why don’t we offer financing to customers who would otherwise find it difficult to obtain financing for Haas machines? Haas didn’t want end users to be subject to the whims of traditional lenders, and believed we could provide a higher level of consistency."

Despite its laudable ideals, Snyder says the recent, overall business boom is enabling private-label lessors to cut into its business, and he acknowledges that CNC Associates had lost some customers. "All the other lenders’ tents are back, but if history is any guide, they’ll likely fold up again during the next downturn, and we’ll still be here," adds Snyder.

Different Users, Different Needs

While some builders are involved heavily in leasing, others are not because they say they don’t see demand for it. Similar to many packaging machine builders serving big users, Sabel Engineering in Sonoma, Calif., reports that its clients typically are such large companies that they don’t need to lease or finance the machines they buy. Also, Sabel’s machines can last for 30 years, which means buying is more cost effective in the long run.

"Leasing hasn’t been a major issue for us because 90-95% of our customers are very large companies such as Kraft and Unilever. If they can justify the expense and return on investment (ROI), then they’ll just go ahead and buy the machines they need. It isn’t a matter of funding for them," says Gary Ensey, Sabel’s sales manager. "Most of our customers are looking for one-to-three-year paybacks, and if they can’t justify a purchase, then they won’t buy."

Though it offers leasing as a service option, Ensey adds that Sabel has only had two lease agreements in his six years with the company. One was with a small company that initially asked for a lease, and then got a bank-based financing at the last minute, and the other was with Golden State Foods, a multi-billion-dollar McDonald’s supplier, which had its own leasing division.

Another barrier to leasing is that some machines are so specialized for individual applications that there’s no other company that could buy them if their initial lessee or buyer couldn’t make the lease payment or defaulted on its loan. "The potential difficulty with customized machinery is that its residual value can be very low due to the limited number of other users, which can make it very hard to resell if needed," says Todd Nguyen, sales and marketing manager for Automation Tooling Systems (ATS), which builds custom, automated assembly and test equipment in Cambridge, Ontario, Canada. "This can make initial lessee payments very high. Conversely, there’s probably more leasing of standardized machines because there are more possible users, so the builder would be more able to sell them in a default situation."

Though it doesn’t lease its products, ATS has been working with GE Capital for several years to help its customers finance their purchases.

Colwick adds that major corporations usually lease large machines for budgetary reasons, and not because they don’t have the cash. Many also lease because they only need a machine for two or three years, and want to be able to unload it when a project is finished. "Our society and culture has been ownership-focused for a long time, and this previously carried over to the business world," adds Colwick.

"However, business now is learning that it’s actual use of equipment that generates profits, rather than traditional ownership." This mind-shift is important because mounting global market pressures are forcing users and builders to increase productivity, adaptability, and survive on far smaller margins. This and the constant need to conserve capital is pushing more users to evaluate and implement leases.

The Productivity Prize

Nick DiFabio, project engineering manager at Bradman Lake, a cartoning and packaging machine company based in Bristol, U.K., agrees that leasing probably is most useful for mid-level machines that are slightly slower and less customized than their specialized counterparts. "Leasing really can help users that are just getting started and need an avenue to get past the capital portion of the incorporating process," he says. "Leasing also is useful for mid-level companies that might just need two more machines to produce the added throughput, operating capital, and profit they need to survive.

Though builders and users need to know what leasing and financing tools are available, they mustn’t lose sight of their planned production gains, which are why they need new equipment, says George Yamane, marketing manager for Mazak Corp., Florence, Ky., which offers a variety of lease rates and terms via its financing division.

"Today’s machine tools are four times more productive in the same space and for the same price than they were 10 years ago," says Yamane. "The PCs that controlled machine motion had eight-bit CPUs in 1981, and now they have 64-bit, dual processors. Machines that we used to replace every 20 years are now being updated every five years. Whether you lease or buy, you have to reinvest continually in new machines that can deliver planned production and profits."

Lease Types and Other Financing

Leases are offered under many names, but there are only a few basic types:

Operating lease also is known as a true lease or tax lease. These types are most closely related to rental agreements, in which the lessor retains title to the machine or asset being leased. The lessor can be the builder, but is most often a third-party financing entity, even if a private-label arrangement makes it look like the builder is securing the title. The main advantage of an operating lease is that it allows users to expense their monthly payments as if they were renting. This allows them to keep the lease off their company’s balance sheet, though it must be listed as a footnote, which keeps the firm’s overall debt lower. Operating leases also allow users to avoid alternative minimum taxes.

Fair market value (FMV) lease consists mostly of lease-to-own arrangements. Bill Colwick, senior vice president, National City Manufacturing Finance, says these leases are similar to operating leases because they too aren’t capitalized and also aren’t listed on the lessee’s books. They’re also usually accounted for as a monthly expense, and include some tax advantages.

Finance lease is most closely related to a mortgage. These leases are structured much like a loan that simply happens to appear on a lease document owned by the lender. These leases usually allow the user to buy their machine at the end of the lease period for $1.

Because this type of lease does appear on the lessee’s balance sheet, users muse be careful to limit the amount of depreciation they take on in a given year to avoid running into alternative minimum tax problems. For example, users that exceed Internal Revenue Service depreciation guidelines might not be able to expense some of their deductions.

To Lease or Not to Lease

It’s probably better to lease if potential customers…

- Don’t have enough cash to buy an essential machine

- Only need your machine for a short time

- Don’t want to pay for spare parts inventory, maintenance, and added training

- Plan to update/replace the machine relatively soon because technology is evolving so fast

- Don’t want to tie up assets in hardware that might be hard to resell

- Need to keep a machine off the balance sheet for accounting or tax reasons

It’s probably better to buy if they…

- Can afford to buy or finance a machine with a traditional loan

- Expect to operate it for many years beyond payback

- Don’t mind holding the title because the machine could be relatively easy to resell if necessary

Better Leasing To-Do List

To help machine builders and users form the best leases, Bill Colwick, senior vice president of National City Manufacturing Finance, says his firm has six main recommendations:

- Deal with an established, reputable leasing company.

- Know the difference between different lease types, such as operating and finance, because a lessee’s borrowing capacity often is tied to their existing total debt. As a result, users may want to take on a tax lease instead of a finance lease, so they won’t be restricted in the amounts they can borrow locally.

- Avoid leases with high purchase options. Some lessors lull users to sleep with low initial payments, and then sock them with end-of-term residuals that are extraordinarily high for the machine involved, much like a balloon payment. Avoiding this situation is important because old machines often are bought and used long beyond the lease term or traded in for new machines.

- Find a lessor that understands your industry, business, application, and the value of your equipment. Lessors need to know their lessee’s industry, so they can structure the most appropriate lease, and make sure the financing tools they’re using best fit the users and builders involved.

- Understand tax indemnification clauses. Every tax lease contains a clause that says if the IRS decides this isn’t a lease, then the lessee or buyer is obligated to reimburse the lessor for changes beyond the lessor’s control. It’s important to know this ahead of time because less-reputable lessors typically make this provision much more onerous, and add much stiffer penalties.

- Consult with your accountant and tax advisor before leasing or financing any large machine or equipment. Remember that these are always major purchases.

Leaders relevant to this article: