There probably has never been a better time than 2021 to sell or recapitalize an industrial technology company, yet this window of opportunity is rapidly closing. Four factors are driving this trend.

- An immense amount of capital in the market that needs to be put to use: Because the mergers-and-acquisitions market slowed considerably during the pandemic, private equity groups are sitting on a mountain of cash they need to deploy. Strategic buyers—that is, competing or complementary businesses—are also well-capitalized and are looking for well-positioned tech companies to fill in gaps in their portfolios. As a result, there is a lot more money than there are deals to invest it in, so business valuations are at record levels, especially for strong industrial technology companies in areas such as automation, sensors and instrumentation, advanced analytics and middleware—software that connects devices and sensors in the manufacturing process.

- The prospect of a significant hike in capital gains taxes next year: It is no secret, especially to business owners, that the Biden administration has proposed to raise the capital gains tax rate from 20% to nearly 40%, although the specifics are still unclear. Assuming this or something similar passes, business owners who wait until 2022 to sell their business are looking at sacrificing a meaningful portion of the sale proceeds to taxes. Accordingly, there is a rush to close business sales by December 31, 2021, but the window for making this happen won’t be open much longer. Because of the time it typically takes to sell a business, businesses that don’t go to market by August are unlikely to make the end-of-the-year deadline.

- The psychological aftereffects of the COVID pandemic: Because of the experience during the COVID pandemic, when government-mandated lockdowns starved businesses for revenue, many business owners have awakened to the fact that an unforeseen crisis could wipe them out, or at least severely deplete their net worth. For many business owners, they may not either have the time nor the youthful energy they once had to rebuild the business through another growth cycle. Fortunately, most businesses, at least those that survived, have since rapidly recovered, and many are enjoying record profits. However, once you’ve seen the very real possibility of a lifetime of work being lost, it’s hard to forget it. As a result, many business owners are thinking it is time to exit or at least take some chips off the table by selling a portion of the business.

- Attractiveness of industrial technology companies to buyers: Adding to this perfect storm is the fact that industrial technology companies are particularly attractive to buyers and are selling for multiples that would have been unthinkable a decade ago. Especially hot are advanced analytics companies that leverage machine learning and data science in their software solutions for a variety of applications within the manufacturing sector. Companies in this sector of IIoT can sell for north of 20 times gross revenue. Sensor and instrumentation companies are also much in demand, fetching prices of 15 times to 18 times earnings before income tax, depreciation and amortization (EBITDA), and automation and robotics companies, which were a prime target for M&A in the early 21st Century, are still getting double-digit multiples of EBITDA.

The fact is, industrial technology companies have always been a hot commodity in the M&A world because, despite premature predictions years ago of the demise of manufacturing in America, manufacturing is still the engine of our economy and industrial technology leads the way in making manufacturing more productive and efficient. Of course, what is considered hot changes over time.

At one time, for example, the diesel engine was the latest in industrial tech. In the early 2000s, sensors were at the vanguard. Then it was robotics, which were red hot around 10 years ago. Today, the hottest category in industrial technology is software that analyzes and acts on the tsunami of data being generated by all of the intelligent devices used in the manufacturing process and monitored by hundreds of sensors and instruments. Certainly other technologies, such as additive manufacturing and drones, are poised for explosive growth within the manufacturing sector.

The importance of advanced analytics is being driven by the push for fully autonomous flow throughout the manufacturing process. Indeed, we are on the verge of fully lights-out manufacturing, where our roles shift to programing, servicing, calibrating and monitoring the machines. From food and beverage to specialty chemicals to pulp and paper to automobiles and more, artificial intelligence (AI) is making intelligent decisions in real time during the manufacturing process.

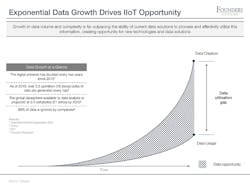

Because of the tremendous amount of data involved and the immense computing power required to process it, manufacturers need to become comfortable with moving to the cloud (Figure 1). The job is usually too big to process with on-premise servers or at the machine level. But we are several years away from this transition, as manufacturers, by and large, are leery of the cloud for security reasons. They want to avoid the possibility that someone outside the plant, who is not on their side, is able to control what happens inside the plant as this can lead to disastrous results, as we have seen recently with the cyberattacks on Colonial Pipeline and JBS meat processing.

Figure 1: The incredible increase in the amount of data produced during the manufacturing process is driving the rise of data analytics software companies. The software helps manufacturers to understand and make use of this information to drive productivity and efficiency. The long-term need for data analytics in manufacturing is demonstrated by the huge gap between the amount of data created and the percentage of it that is actually used. (Source: Founders Advisors)

Manufacturing IT departments are especially wary of the cloud, not only for security reasons, but also because it is much easier to integrate new software into their on-premise system than figuring out how to take everything to the cloud.

We are pretty far along the technology adoption curve toward the cloud in many sectors, but today the real opportunity for manufacturing software is on-premise or on the edge—that is, at the machine level.

How to increase attractiveness

Accordingly, industrial technology companies that can integrate with a manufacturing company’s internal network—inside the firewall—are more valuable today. And, value-wise, it is especially important that these companies’ products, whether advanced analytics or sensors or other technologies, are able to easily interface with control components, which are already inside the firewall, running at the edge and on-premise.

Industrial technology companies can also make themselves more attractive to buyers if they focus on and address the application-specific needs of an industry vertical—for example, one instrumentation company developed a solution, using infrared cameras, to control ladles in the steel industry. Strive to solve a clearly identifiable problem in a specific industry.

And, to further maximize its value, your company must be fully operational, having clients who will run your solution continually for an extended period of time, not just a collection of pilot projects that may or may not lead to real business. For example, we’ve seen early-stage companies that derive as much as 80% of their gross revenue from pilot projects and proofs of concept. Buyers know this is not a sustainable model. They are looking for going concerns with dependable annual recurring revenue. As a rule of thumb, a key threshold for an advanced analytics company is to achieve at least $1 million of annual recurring revenue with an eye toward $5 million of annual recurring revenue to achieve a step change in salability.

If you have been thinking that it may be time to reap the reward of building a great industrial technology company, there has never been a better time to act, especially if you are in the automation software or advanced analytics business. To assure a high valuation for your company, strive to dominate an industry vertical and don’t be tempted into putting most of your eggs in the pilot project and proof of concept basket. Finally, act fast. This window of opportunity is closing soon.

About the author

About the Author

Gene Bazemore

Founders Advisors

Leaders relevant to this article: