PMMI Report Says U.S. OEMs Will Build More and Their Customers Will Buy More in 2004

Of eight market segments studied in a recent packaging machinery purchasing study, the six markets that collectively account for more than 81% of the machinery industry’s annual dollar volume (beverages, chemicals, durables, foods, personal care and converters) are expected to increase expenditures for packaging machinery when this year is over. Sales to non-durables/soft goods and pharmaceuticals/medical products segments are expected to be off slightly, but the demand by the pharmaceutical/medical products segment will remain substantialat or near 2003 levels.

The Case for Growth

Barring unforeseen major external influences, U.S. demand for packaging machinery will be driven higher by several key factors and trends, says the 7th Annual U.S. Packaging Machinery Purchasing Plan Study, from the Packaging Machinery Manufacturers Institute (www.pmmi.org).

Replacement of older machinery with current higher-tech models remains a priority in the market. The survey reveals that machine customers have come to recognize the value of the new technology as a vehicle for improving productivity. As a result, a large number of packaging machines will be targeted for replacement in 2004, as they were in 2003.

The report quotes a producer of oral care products as saying, "We’re looking to gain a competitive edge through increased productivity by incorporating new machinery into our lines." A beverage bottler says, "Our plant is replacing machinery this year specifically to avoid downtime caused by breakdowns."

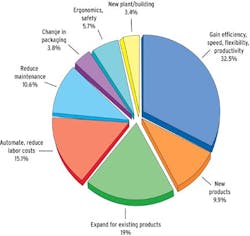

New machines are being added to expand automation and reduce labor costs. According to the report 15% of respondents ordering machines this year cited the need to expand automation and reduce labor costs as the primary reason for installing new packaging machinery in 2004.

The study quotes a producer of clinical foods and vitamin products as saying, "Our company is determined to automate the configuration of our existing packaging lines this year; they’re much too labor intensive."

The Changeover Challenge

The trend continues toward more-frequent machine configuration changeovers, as end users deal with the proliferation of product varieties and sizes that must run on the same packaging line. "Our customers are demanding a greater variety of product sizes and packages, so we’re looking for machinery that is easy and quick to changeover," a packager of auto products reports in the survey.

Reasons For Ordering Packaging Machinery in 2004

Attention to ergonomics, product security, and safety issues grow, as more respondents identified these issues as main reasons for ordering packaging machinery this year. Though still a minor "primary factor", the issues are gaining more prominence in end users’ overall planning. "We plan to eliminate a lot of repetitious handwork through increased automation," reports a health food packager.

Restraints to Higher Growth

Despite the generally positive outlook for machinery sales, the survey says many factors have the potential to limit the magnitude of that growth in 2004:

·

A certain amount of lingering concern over the staying power of the economy may cause some end users to resume a wait-and-see investment attitude.·

Concern about geopolitical instability·

Slower than expected reduction of excess capacity.·

Continuing negative effects of mergers, plant closings, corporate restructurings, operational consolidations, and shifting of some production operations out of the country.·

Negative effect of natural gas prices on plastic film packaging material costs.·

Impact of used and rebuilt machinery and retrofits on total demand. According to the survey, 21% of respondents will order some used packaging machinery as an alternative to new units, and 34% plan to order one or more rebuilt machines.Add or Replace? New or Rebuild?

Of the respondents' projected expenditures for packaging machinery this year, 56.5% will be allocated for additions to packaging lines and 43.5% will go for replacements for existing units. Despite the category’s majority role, additions have traditionally accounted for a considerably higher proportion of the total during periods of growth, however, reminds the study, this has not been a normal growth cycle.

Of the total dollars to be spent on packaging machinery in 2004, new units will account for approximately 89%, while used and rebuilts represent the balance. This compares with 90% for new machinery in 2003.

Retrofitting older packaging machines with component upgrades that raise the units’ capabilities to nearly equal those of current machinery models has been growing rapidly. The report reveals 52% of respondents will upgrade one or more of their existing packaging machines through some form of retrofitting in 2004, down slightly from last year, but up significantly from 39% in 2002.

Attitudes About Servos and Robotics

Survey participants were asked if the new machines they'll buy will include servo motion control. Forty-four percent indicated at least one of the machines being ordered this year will be servo motion control-based. Most importantly--and reflective of the market’s growing preference for servos, 70% said they specified that those machines be fitted with the servo controls.

Thirty-seven percent of respondents reported their company/plant will order one or more packaging machines configured with robotics. While the spread of robotics is no doubt advancing, says the study, the gains have been erratic of late, with a surge in demand one year and a pull back the next. The growing promotion of robotic capabilities in packaging applications through print advertising, the Internet, and at trade shows has made an increasing number of end users more aware of the potentials for labor reduction and efficiency enhancement, says the survey.

The Growing Role of System Integrators

According to this year’s data, 37% of respondents outsource some portion of design and/or installation of their packaging lines to system integrators, up from nearly 33% in early 2003. The increase is believed to be attributable to the residual effects of downsizing, which have caused more companies to place greater reliance on third-party engineering resources.

Attention to RFID Requirements

The survey results revealed that despite enormous publicity, RFID does not yet represent a major influence on packaging machinery decisions. Only 26.1% indicated they expect to be set up for RFID within the year, 30.5% said they're not sure when, and 23.3% stated it is "not a concern."

Machinery Manufactured Outside North America

More than 63% of the sample’s respondents reported their company/plant purchases some quantity of packaging machinery manufactured outside the U.S. and Canadaup slightly from 61.6% in 2003. The estimated dollar value of their purchasesaccording to the dataaccounted for 26.4% of the sample’s total expenditures for packaging machinery during 2003, but will fall to 25% this year

Leaders relevant to this article: