US lags behind China in factory robot deployment

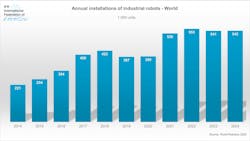

The new World Robotics report by the International Federation of Robotics (IFR) recorded 393,700 industrial robots working in U.S. factories, an increase of 3% year-on-year. Annual installations reached 34,200 units in 2024, which is down 9%, but 30% higher compared to 10 years ago.

Nevertheless, the United States has growth potential: China, the world's largest market for industrial robots, has five times more operational stock than the United States.

“The United States is highly automated running the third-largest stock of industrial robots worldwide, behind only Japan and China,” said Takayuki Ito, president of the International Federation of Robotics. “However, a comparison of the U.S. and China reveals the enormous automation potential of the world's largest economy by GDP.”

With annual installations ranging from 26,200 to 40,400 units, the United States is in line with other leading adopters, such as South Korea, Germany and Japan. But China installed 295,000 industrial robots in 2024, which is almost nine times more than the United States.

A long-term perspective confirms the automation gap: In 2024, China had around five times more factory robots in use (2,027,200) than the US (393,700 units). This development is based on China’s national robotics strategy released in December 2021, with the aim of enhancing competitiveness.

National robotics strategy

The Association for Advancing Automation (A3) strongly advocates for a national robotics strategy in the United States. Its comprehensive vision outline, released in 2025, sets out policy recommendations for maintaining global competitiveness.

Most U.S. robot hardware is imported from Japan and Europe. The situation is different in China, where 57% of the market is served by domestic manufacturers.

In addition, Chinese manufacturers are leading the way in the adoption of robotics automation in new customer industries, extending the reach of robotics beyond the traditional domains of the automotive, metal/machinery and electro/electronics sectors.

US customer industries

In the United States, the automotive industry remains by far the largest customer market, accounting for 40% of total U.S. installations in 2024: Sales rose by 11% to 13,600 units. On a global scale, the United States has the second largest production volume of cars and light vehicles, following China.

The metal and machinery industry installed 3,500 units, which is down 15%. The U.S. electrical/electronics industry went down by 23% at 2,800 units newly installed. Robot installations in the food and beverage industry gained 21% to 2,200 units in 2024.

Canada and Mexico

In Canada, robot demand from the automotive industry went down 28% to 1,800 units, accounting for 47% of total installations in 2024. Installations across all industries declined by 12% to 3,800 units. Canada has close ties to the U.S. economy and is thus strongly affected by U.S. tariffs. The automotive industry has cancelled many major investment projects due to policy uncertainty. Robot installations in Canada are, therefore, expected to further decline.

In Mexico, demand from the automotive industry declined by 11% to 3,500 units in 2024. This segment accounts for 63% of total installations. Installations across all industries declined by 4% to 5,600 units, continuing the downswing of the previous year.